Content

Creating a direct labor budget is a necessary step for businesses involved in production. Whether you’re manufacturing products to sell or just buying them for resale, you’ll need to create a materials budget, which will directly tie to your sales budget. Because you’ve already estimated your sales totals for the upcoming year, it will be much easier to create your materials budget.

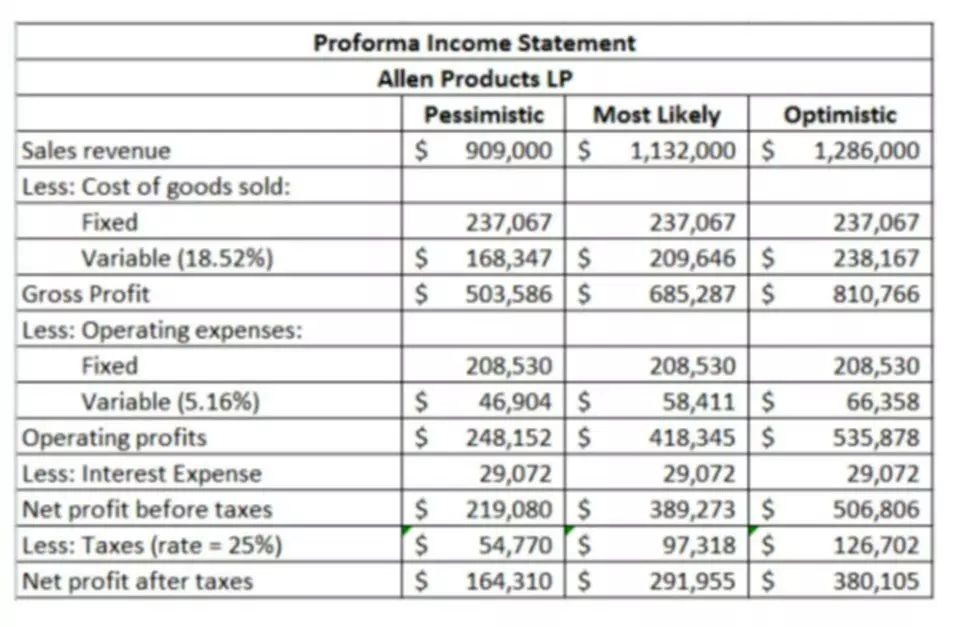

During periods of rapid growth, working capital can be a strongly negative number, since the company must invest in more accounts receivable than usual. Altogether, the Operating, Cash Flow, and Capital Budgets depict a company’s expected financial performance. Essentially, viewed from a different angle, the Master Budget consists of the firm’s projected Income Statement, Balance Sheet, and Cash Flow Statement for the upcoming years. Once you have the revenue prediction, you can move on to estimating the Production Budget which tells you how many products a firm needs to manufacture in the future.

How To Use a Rolling Budget

It includes both short-term and long-term goals, and sets forth a plan of action for achieving them. The budget is usually prepared on an annual basis, but can also be done on a quarterly or monthly basis. It also aligns stakeholders’ expectations with the business’s financial goals. Many businesses fail to communicate effectively with stakeholders, such as investors or department heads, when creating their master budget. To avoid this mistake, businesses should involve stakeholders in the budgeting process and ensure they are aware of the assumptions and projections that underpin the budget. Businesses that fail to account for cash flow when creating their master budget can quickly face financial difficulties.

“A lot of people think budgeting is penny-pinching, but that’s not really what it is,” says Steve Lord, a managing director at financial services firm Burkland. The selling and administrative expense budget deal with non-manufacturing costs such as freight or supplies. The first schedule to develop is the sales budget, which is based on the sales https://www.bookstime.com/articles/what-is-a-master-budget forecast. The sales budget is not usually the same as the sales forecast but is adjusted based on managerial judgment and other data. The last part of the Annual Business Plan is the Investment or Capital Budget. It shows the total amount that a company plans to generate by selling (or acquiring) fixed assets such as machinery, plants, or cars.

What is the Master Budget?

It covers indirect expenses that cannot be directly traced to a product or service. The overhead budget is essential for managing indirect expenses, optimizing cost structures, and achieving profit margins. Budgeting is an essential function of any business, necessary for both financial planning and growth. A master budget gathers a company’s lower-level budgets and incorporates them into one central document for ease of reference.